direct vs indirect cash flow gaap

Alternatively the direct method begins with the cash amounts received and paid out by your business. If the cash flow estimates used were based on assumptions about the invasion or sanctions and those assumptions could.

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

. Non-cash expenses like depreciation and amortization are ignored in the direct method while they are taken into consideration in the indirect method. With a regular cash flow statement prepared using the direct method we take the following amounts from our accounting records and input them directly in the first section of the statement. Under IFRS Standards there are no scope exceptions and all companies must present a statement of cash flows in a complete set of financial statements.

Companies may have disclosure obligations under the federal securities laws related to the direct or indirect impact that Russias invasion of Ukraine and the international response have had or may have on their business. There are no presentation. Statement of cash flows resulted from the efforts and ideas of various RSM US LLP professionals including members of the National Professional Standards Group as well as.

Interest received must be classified as an operating activity. Cash paid to employees. Direct vs Indirect Cash Flow Statement.

Concept Monetary For Period. GAAP requires a reconciliation of net cash flow from. The following are the common types of adjustments that are made to.

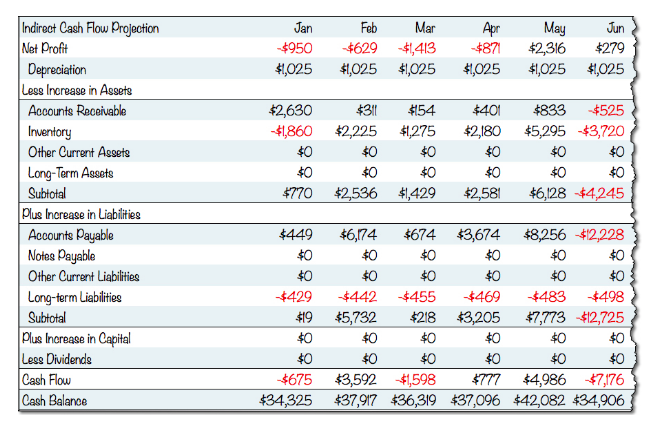

In contrast the indirect method starts with net income for-profit entities or the change in net assets NFP entities adds back non-cash expenses removes gains and losses and adjusts for the changes in current asset and current liability accounts. Indirect method is the most widely used method for the calculation of net cash flow from operating activities. The net income is then followed by the adjustments needed to convert the accrual accounting net income to the cash flows from operating activities.

Indirect cash flow methods. 106 Both encourage the use of the direct method. 108 In addition unlike IFRSs US.

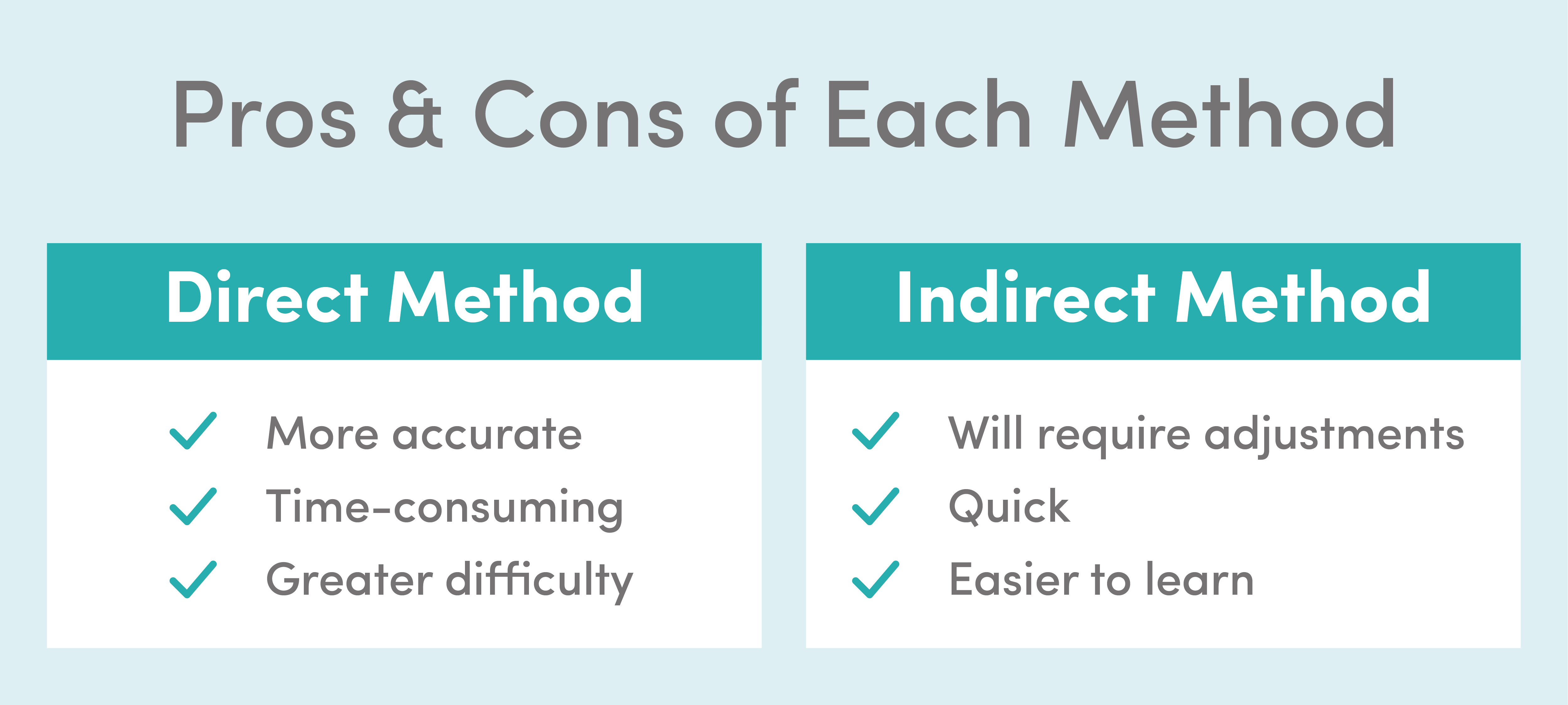

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Comparing the Direct and Indirect Cash Flow Methods.

Direct Financing Lease Selling Loss. Cash paid for other operating expenses. Statement of cash flows always required under IFRS Standards.

While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses. Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities. The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities.

The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. Classified Balance Sheet Income Statement with Gross Profit and Operating Income Loss Indirect Cash Flow Statement US GAAP Cash Flows Statement Indirect Method Tree View of same information Examples of Cash Flow Statement. Indirect Method vs.

The cash flow statement is divided into three categoriescash flows from operating activities cash flows. GAAP also calls the indirect method the reconciliation method. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash.

Cash receipts from customers. The indirect method begins with your net income. Here are the key differences between direct vs.

The direct method details where cash comes from and where it goes. The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments. Also if a company.

Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. US GAAP also requires similar adjustments. When the indirect method of presenting a corporations cash flows from operating activities is used this section of SCF will begin with a corporations net income.

The direct method only. The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net income to derive cash flow from the. Exceptions exist under US GAAP.

Under US GAAP defined benefit pension plans that present financial information under ASC 960 3. Indirect cash flow method is the type of transactions used to produce a cash flow statement. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No.

One of the key differences between direct cash flow vs. 95 permit the direct and the indirect method of reporting cash flows from operating activities. Cash paid to suppliers.

In the direct method reconciliation is used to separate various cash flows from others while in the indirect method the conversion of net income is done in cash flow. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Either the direct or indirect Net income must be reconciled to net cash flows from operating activities if the indirect method is used.

However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations. However of the two the direct method is generally encouraged.

Cash Flow Statement Indirect Method Cash Flow Statement Positive Cash Flow Cash Flow

Direct Vs Indirect Method Statement Of Cash Flows Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

2022 Cfa Level I Exam Cfa Study Preparation

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Basics

Statement Of Cash Flows Direct Method Youtube

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Direct Vs Indirect The Best Cash Flow Method Vena

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Positive Cash Flow

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Cash Flow From Operating Activities Direct And Indirect Method Efm

The Indirect Cash Flow Statement Method

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal